Assessor

Property Tax Exemptions:

- Homestead Exemption

If a person owns the land and lives on the land as of January 1st of this year they may qualify for this exemption. Once you are receiving the benefit of this exemption you do not have to file again unless you move to a new property. - Double Homestead Exemption

Anyone who qualifies for the homestead exemption and has an annual household income of $20,000 or less may qualify for this exemption. The taxpayer must show proof of income and must re-apply every year until they reach the age of 65. At age 65 the exemption becomes permanent and does not have to be re-filed every year. - Senior Valuation Limitation (senior freeze)

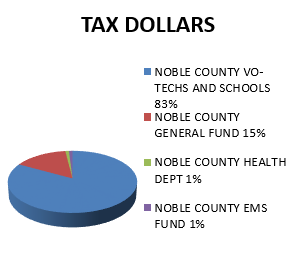

This will freeze the value on the property so that the value cannot be increased unless the property is improved. To qualify, the taxpayer must be 65 or older and show proof of an annual household income equal or less than the annual HUD median income level for Noble County (Contact the Assessor for the current income level). This income is based on the HUD income levels and changes each tax year. The freeze will be placed on the value not the taxes. Taxes will continue to fluctuate each year based on the needs of the schools, counties, and any bond issues passed by the voters of Noble County. - 100% Disabled Veterans

Any Veteran who has received a letter from the Veterans Administration showing that they are 100% disabled with no future evaluations may be exempt from taxes on their homestead property. A copy of the letter and picture ID are required.

Mandy Snyder

Noble County Assessor

| Address: | 300 Courthouse Drive #9 Perry, OK 73077 |

| Telephone: | 580-336-2185 |

| Fax: | 580-336-2447 |

| Email: | mandy@noblecountyassessor.com |

| 1st Deputy: | Brenda Landes |

| blandes@noblecountyassessor.com | |

| Deputy: | Nikki Woodson |

| nikki@noblecountyassessor.com |